The ICT Mentorship 2022 EUR/USD Intraday Strategy is a sophisticated trading model that combines liquidity sweeps, Fair Value Gaps (FVGs), Market Structure Shifts (MSS), and Smart Money Tool (SMT) analysis for high-probability EUR/USD setups during specific session windows.

Core Concept of the ICT 2022 Model

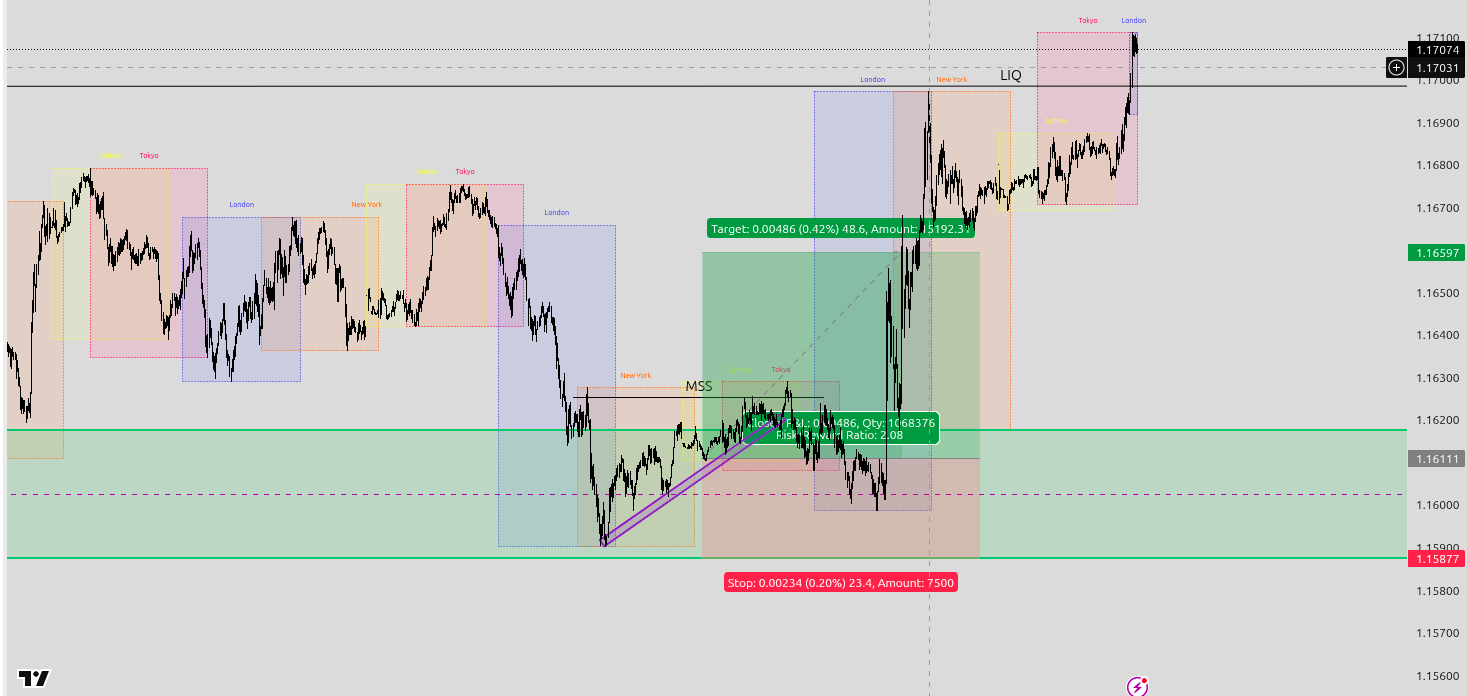

This intraday strategy from the 2022 ICT Mentorship follows a systematic approach:

- Identify liquidity pools (PDH, PDL, session highs/lows)

- Wait for liquidity sweeps to trigger stop hunts

- Confirm displacement moves that create Fair Value Gaps

- Enter on pullbacks after Market Structure Shifts or Change in State of Delivery (CSD)

- Use SMT divergence with DXY for additional confluence

- Trade during high-volatility sessions for faster setup formation

This model leverages institutional order flow concepts to identify where smart money is positioned and how they manipulate retail traders.

IST Session Windows for EUR/USD

Trade only during these high-volatility windows for optimal results:

| Session | NY Time | IST Time | Why Trade Here |

|---|---|---|---|

| London Kill Zone | 02:00–05:00 NY | 12:30 PM – 3:30 PM | First big liquidity moves in EUR/USD |

| NY Open Window | 07:00–10:00 NY | 4:30 PM – 7:30 PM | Strongest overlap volatility |

Why These Sessions Work

- London Kill Zone: European markets open, creating initial volatility

- NY Open: Maximum overlap between London and New York creates peak liquidity

- Institutional Activity: Smart money is most active during these windows

Step-by-Step Execution Plan

Step 1 — Set Your Bias (H1 → M15)

On the 1-Hour Chart, mark:

- PDH (Previous Day High)

- PDL (Previous Day Low)

- Session highs/lows from London/NY sessions

On M15 Chart, refine these zones and identify where liquidity pools are sitting.

Step 2 — Watch for the Sweep

During your session window, monitor for price breaks past key levels.

Valid Sweep Criteria:

- Price pushes through cleanly, taking out stops

- Sharp rejection back inside quickly

- Creates obvious stop hunt pattern

Example: PDH at 1.0950 → London open drives to 1.0953 → sharp rejection to 1.0940

Step 3 — Spot Displacement + FVG

After the sweep, look for impulsive candle move in the opposite direction.

Displacement Requirements:

- Breaks recent structure

- Leaves an FVG (gap between wicks in consecutive candles)

- Shows strong momentum rejection

Step 4 — Drop to Execution Timeframe (M5 or M1)

Execution Process:

- Mark the FVG from the displacement candle

- Wait for retrace into the FVG zone

- Look for MSS or CSD on M1–M5 timeframes

- Confirm the structure break before entry

MSS/CSD Definition: Small break in market structure confirming the directional change

Step 5 — Optional SMT Confluence

SMT with DXY (Dollar Index - inversely correlated with EUR/USD):

Bearish SMT Divergence:

- EUR/USD makes higher high on sweep

- DXY fails to make lower low

- Bearish confirmation for shorts

Bullish SMT Divergence:

- EUR/USD makes lower low

- DXY fails to make higher high

- Bullish confirmation for longs

If SMT matches your bias, confidence level increases significantly

Step 6 — Entry & Risk Management

Entry Strategy:

- Enter at or near 50% retrace of the FVG

- Wait for MSS confirmation on lower timeframe

Stop Loss Placement:

- Just beyond the extreme of the sweep candle

- Add few pips buffer for market noise

- Risk Size: Maximum 0.5–1% per trade for intraday scalps

Step 7 — Target Setting

First Partial Profit:

- Nearest opposing liquidity (intraday swing high/low)

- Take 50% position off at 1:1 or 1.5:1 RR

Runner Target:

- 2R–3R risk-to-reward ratio

- Next session liquidity pool

- Exit before major news unless trading the spike

Complete Trade Example in IST

London Kill Zone Setup

12:30 PM IST → London Kill Zone starts, PDH identified at 1.0950

12:45 PM IST → Price spikes to 1.0953, taking out PDH stops, then sharply rejects

M15 Analysis → Displacement candle down to 1.0938, leaving FVG from 1.0948–1.0943

M5 Execution → Price retraces to 1.0945 (50% of FVG) and forms bearish MSS

SMT Check → DXY fails to make lower low, confirming bearish divergence

Trade Execution:

- Short Entry: 1.0945

- Stop Loss: 1.0955 (10 pips)

- TP1: 1.0930 (15 pips - 1.5R)

- TP2: 1.0915 (30 pips - 3R)

Why This Strategy Gives Multiple Daily Opportunities

Session Diversity

- Two trading windows daily (London + NY)

- Each session can provide both bullish and bearish setups

- Different liquidity pools create varied opportunities

Timeframe Flexibility

- M1/M5 execution means micro-liquidity grabs qualify

- Multiple FVG formations during active sessions

- Quick scalping opportunities throughout the day

High Probability Confluences

- Multiple confirmations required for entry

- SMT analysis adds institutional insight

- Session-based approach aligns with smart money activity

Advanced Tips for Success

Market Structure Recognition

- Understand MSS vs CSD concepts thoroughly

- Practice identifying valid displacement moves

- Study historical sweep patterns

Session Preparation

- Mark levels before session start

- Set alerts at key liquidity zones

- Monitor DXY for SMT opportunities

Risk Management

- Never risk more than 1% per trade

- Use proper position sizing calculations

- Exit before major news events

Final Takeaway

The ICT Mentorship 2022 EUR/USD Strategy transforms forex trading from gambling into a systematic approach based on institutional order flow. By understanding how smart money manipulates liquidity and creates imbalances, traders can position themselves on the right side of major moves.

Success Factors:

- Patience to wait for perfect setups

- Discipline to follow the model exactly

- Practice to recognize patterns quickly

- Risk management to preserve capital

This model requires dedication to master, but when executed correctly during the right sessions, it offers some of the highest probability trades in the EUR/USD market.

Tags

ICT Mentorship 2022 EUR/USD Strategy Intraday Trading Fair Value Gap Market Structure Shift SMT Divergence DXY Correlation Forex Scalping Session Trading Liquidity Sweep